The past rate you pay is more than the fresh new sticker for the car screen. Cause for costs eg fees, title costs, and upcoming vehicle restoration whenever figuring automobile costs. If you’re not sure exactly how much you really can afford, the Car Value Calculator may help.

Thought Refinancing Your Car finance

Refinancing your existing mortgage might be a beneficial choice to save your self currency while keeping your vehicle. If your credit provides increased, talk about this one to lower the payment and you can/otherwise pay faster attract full. Check out all of our Automobile Re-finance Calculator to find a better experience regarding whether refinancing is definitely worth they.

Opt for a shorter Mortgage Term

New faster the loan term is, the better your own monthly payments could well be – however the less you’ll be able to shell out into the attract complete. Select the quickest financing length whoever monthly obligations match conveniently on your own funds. Fiscal experts strongly recommend financing regards to only about 48 so you can 60 months for new vehicles, and you may thirty-six to forty-eight months getting utilized vehicles. Longer than one, and you might end with bad security (due more about the automobile than simply it is worthy of). In the event your monthly premiums to possess a particular auto are too high for a loan name because variety, consider a less expensive vehicles.

Shop around

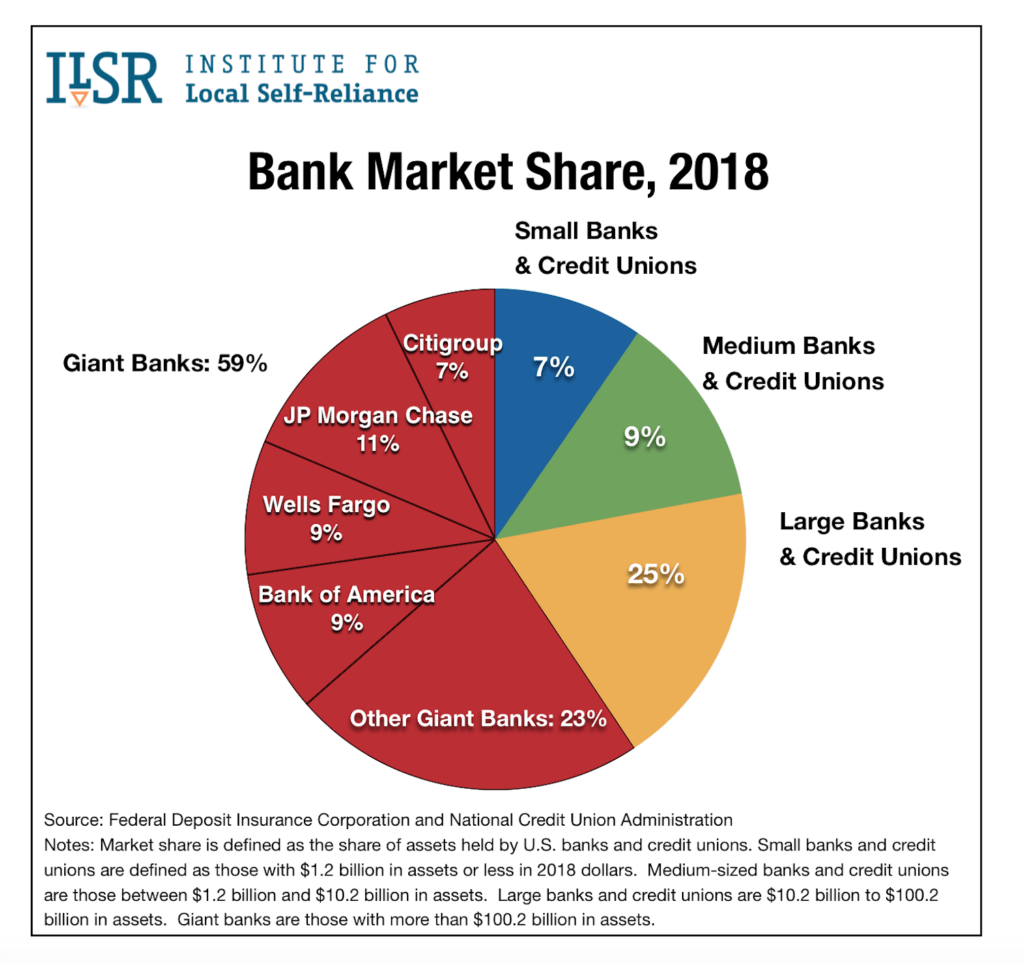

Just as researching quotes away from more car insurance business can assist you can see a low costs, evaluating funds from more loan providers makes it possible to get the best mortgage. Research rates that have less than six loan providers, for example borrowing from the bank unions, banking institutions, and you can automakers.

Before you buy a great used-car, get a great pre-purchase examination out of an auto mechanic to test to have maintenance problems that will be costly to resolve.

Car loan FAQ

Lead credit concerns obtaining a loan regarding a lender otherwise borrowing commitment in advance of going to a car dealership, taking way more liberty inside negotiating terminology. Provider financing, at the same time, was create after negotiating a car get in the provider. A knowledgeable the fresh new auto loans usually are from loan providers aside from the brand new provider. We advice getting pre-accepted to the financing just before checking out a dealership having good most readily useful understanding of available financial support options. Our Specialist versus. Bank Financial support Calculator helps you influence the most suitable choice having you.

How can i optimize my personal exchange-for the?

New trading-inside the value ‘s the matter a dealership is ready to shell out to suit your current vehicle when purchasing an alternative that. Cleansing the vehicle, and also make minor fixes, obtaining several offers, and you may settling into the dealer can help maximize brand new trade-when you look at the worth installment loans Jacksonville. The higher their trading-from inside the really worth, the low your month-to-month car loan money.

To buy an alternative auto offers the most recent features, an assurance, and frequently all the way down rates. Although not, referring which have a high cost, faster depreciation, and costlier insurance. Buying a beneficial used car generally speaking function less upfront prices, much slower decline, and you may potentially lower insurance – whether or not a high rate of interest to your financing. Normally, your own monthly financing repayments would be all the way down getting an effective car.

Consider your budget, wanted has, therefore the trade-away from ranging from upfront prices and you will much time-term really worth when determining ranging from an alternate otherwise used-car.

Ought i pay back an auto loan early?

You could commonly pay-off an auto loan very early without penalties, however, make sure you see the financing terms, since the certain preparations could have prepayment charges. Investing more the minimum will help cure total focus repayments. Bringing to come on your loan costs may help you when the your beat their revenue stream or unexpected expenses will come up, since you may manage to stop your car payments if you’re to come (remember you can easily nonetheless accrue attention).