cockroach theory in hindi

That frustration is sometimes expressed as anger and striking out verbally at parents. They will teeter between being engaged with the family and wanting to retreat by themselves or with friends for several hours at a time. Frustration drives ineffective leaders backward, inward, and downward. To turn such negative traits into positive ones, let us understand that we must respond and not react. Remember the cockroach theory reiterated by Sundar Pichai, CEO, Google. It’s much more likely to be second-rung companies in the same sectors.

Reactions are always instinctive whereas responses are always well thought of a beautiful way to understand LIFE. It is a period when boundaries are tested, doors are slammed, and voices often raised. When they express their frustrations in anger, that anger can be unsettling. Disappointment and general helplessness stem from a teen’s desire to be more independent from his/her parents and the frustration that he/she can’t yet enjoy the freedoms of an adult.

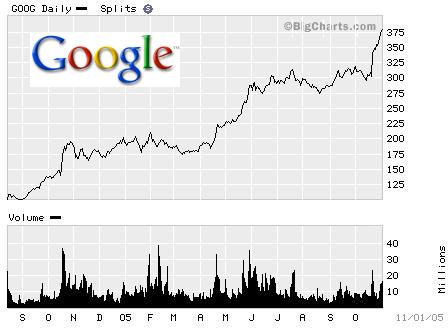

The results of cockroach theory can have devastating consequences for whole industries as a result of, upon receiving unfavorable news about one company, traders anticipate related information about others. Often well-liked outrage will trigger governing authorities to look into different companies. Consequently, investors in the trade in question have a propensity to divest, there will be a drop within the value of a company’s stock.

Dinosaurs, the strongest of the carnivores went extinct about 65 million years ago after living on Earth for about 165 million years. No matter how powerful or ferocious any living being is, yet it cannot escape the fangs of time. Adolescents are often distracted by feelings like anger, disappointment, and general helplessness when they face challenges at school or at home. Here are the lessons one can learn from this short but meaningful story. If you didn’t have a chance to stumble upon this story, let me share it here.

Moreover, information of impropriety at one firm could result into panic and public outcry, which often ends up piquing the curiosity of government regulators, who will investigate trade opponents. Just as a result of a stock has been pasted for an earnings development fall doesn’t mean it turns into a screaming buy. Every administration will cite unfavourable brief-term customer order motion.

The Self Development Theory by a Cockroach

In the relay of throwing, the cockroach next fell upon the waiter. The waiter stood firm, composed himself, and observed the behaviour of the cockroach on his shirt. When he was confident enough, he grabbed it with his fingers and threw it out of the restaurant. At a restaurant, a cockroach suddenly flew from somewhere and sat on a lady.

What is the difference between react and respond cockroach?

Reactions are always instinctive, often out of control, whereas responses are always well thought of. Thoughtless reactions can get us into unwanted trouble; whereas thought out practical and sensible responses can help us out of trouble. Person who is HAPPY is not because Everything is RIGHT in Life.

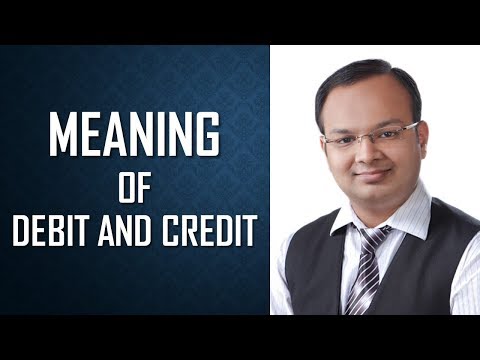

Here’s another story, or rather a speech by Sundar Pichai, that was being massively shared a while back. It’s a speech about the ‘cockroach theory’ for self development. I realized that it is not the shouting of my father or my boss or my wife that disturbs me, but it’s my inability to handle the disturbances caused by their shouting that disturbs me. I realized that, it is not the shouting of my father or my boss or my wife that disturbs me, but it’s my inability to handle the disturbances caused by their shouting that disturbs me.

Cockroach Theory- A beautiful speech by Sundar Pichai.

The article is based on a story of what occurred in a restaurant. The story tells of how a cockroach landed on one of the women in the group, and the way she instantly reacts to this by screaming and wildly flailing her arms to rid herself of the cockroach. When a enterprise reveals unhealthy monetary or operational information, management tends to downplay the extent of the problem, and so tends to present the most optimistic view of the scenario.

Reactions are instinctive whereas responses are intellectually.Reactions are always instinctive, whereas resp… The waiter stood up, looked after himself and saw the cockroach behavior on his shirt. When he was quite confident, he caught it with his fingers and threw it out of the restaurant. When man is asleep, they take over the kitchen, closets and wash rooms. Infuriated at the site of this pest, man tries repellents and sprays to clear out this scavenging insect.

In a restaurant, a cockroach suddenly flown from somewhere and sat on a woman. I am Shehnaz Gujral, an academician with two decades of experience. I thoroughly enjoy my profession as it gives me an opportunity to interact with young minds. As a planet, we have witnessed the endangered as well as extinct species.

What is the cockroach management theory?

What Is the Cockroach Theory? The cockroach theory refers to a market theory that states when a company reveals bad news to the public, many more related, negative events may be revealed in the future. Bad news may come in the form of an earnings miss, a lawsuit, or some other unexpected, negative event.

Find December 2015 current affair in Question and Answer format therefore it helps the reader to prepare himself/herself in GK format. It is not the cockroach but the inability of those people to handle the disturbance caused by the cockroach. Similarly, situations will make us angry, but if we could stop, think and then respond, anger can be controlled. The cockroach jumps from one person to the subsequent, and a waiter comes to the group’s rescue. Despite the fact that the cockroach also managed to land on the waiter’s shirt, his reaction was completely different. Instead of screaming and flailing, he stood agency, observed the cockroach’s behavior then calmly caught it and threw it out the door.

Motivational Story For Students In Hindi

When he got courage he grabbed it and threw it out of the restaurant. Sundar Pichai’s growth in Google is only due to his foresightedness towards the company’s development… At Stanford University Steve Job’s address commencement in 2005 is one of the most famous speeches “Stay Hungry Stay Foolish”.

Man fails umpteen times and tries to outfox this mighty insect at the odd hours of night with spray attacks and food traps. Survival tactics surpass the futile efforts of self- proclaimed intelligentsia. Eliminating a cockroach infestation is the most herculean task. It is time to reflect and absorb lessons from an ordinary pest who has shown extra ordinary behaviours ever since time immemorial. If we try to bridge the abyss in unison, filling the cracks and cuts of prejudice, inequality and unsecular diffidence, our tribe too will flourish as the most humane humans.

Read this Web-Story

Therefore the author submits that non secular organizations select and prepare leaders from amongst immigrants rather than transferring clergy to the United States. But in many instances, a company’s higher management team might try to downplay the consequences of any bad information. In fact, some attempt to turn it round by putting a constructive spin on the information even when there’s an impact on the corporate’s share worth. Indian markets aren’t as immediately influenced by pure Net enterprise, although Nasdaq actions do affect home market sentiment. Current valuations strongly underline the expectations that revenue growth will remain at the very excessive ranges of the current few quarters.

Sundar Pichai, Google CEO in his inspirational speech spoke about the Cockroach Theory. The cockroaches are an ancient group, dating back at least as far as, the Carboniferous period, some 320 million years ago. Cockroaches are abundant throughout the world and live in a wide range of environments, especially in the tropics and subtropics. They can withstand extremely low temperatures, allowing them to live in the Arctic. This obnoxious pest can surely be our life coach and help us unfold the mysteries of life.

A beautiful way to understand : LIFE – by Sundar Pichai CEO Google

In 2008 we were honoured by the International Newspaper Marketing Association , yet another international recognition for ‘Youth Audience Development’. In 2013 we were again honoured by the celebrated World sundar pichai cockroach theory Association of Newspapers as the ‘Times NIE – World’s Best Youth Engagement Program’. Well that’s quite a bit of an insight into the mind of the person who runs Google or better said, the internet.

- Infuriated at the site of this pest, man tries repellents and sprays to clear out this scavenging insect.

- Similarly, situations will make us angry, but if we could stop, think and then respond, anger can be controlled.

- The cockroaches are an ancient group, dating back at least as far as, the Carboniferous period, some 320 million years ago.

- Reactions are always instinctive whereas responses are always well thought of a beautiful way to understand LIFE.

It’s not the traffic jams on the road that disturbs us, but our inability to handle the disturbance caused by the traffic jam that disturbs us. More than the problem, it’s our reaction to the problem that creates chaos in our life. Sundar Pichai continues to make global news every now and then. Stories about his past, schooling and college days are always in circulation.

Put simply, whenever you see one cockroach, there may be many extra you can’t see instantly. Her reaction was contagious, as everyone in her group also got panic. With a panic stricken face 🧟 and trembling voice🤷, She started jumping, with both her hands desperately trying to get rid of the cockroach. Her reaction was contagious, as everyone in her group also got panicky. With a panic stricken face and trembling voice, she started jumping, with both her hands desperately trying to get rid of the cockroach.

Who shared cockroach theory which has important implications in communication?

Sunder Pichai was making a narrative of something he has witnessed in a restaurant that was about a cockroach and how its resting on people made them react. His efforts was to tell his audience that 'responding' to a situation is desired over 'reacting' to a situation.

.jpeg)