If there is noticeable mildew and mold towards any surfaces of the home, think of this a significant issue toward appraiser. A sign of mold is a powerful sign of a drip regarding the roof otherwise pipes. Mildew is also decompose wood and will be a medical danger for customers.

Drainage

Due to the fact might anticipate, there has to be adequate drainage inside the property. It indicates gutters, downspouts, drain pipes, and every other feature that removes liquids on the household.

If you have pooling drinking water around the home, this may trigger water damage and you may a refused app. Drinking water need to drain off the house.

Option of the home

The brand new Virtual assistant appraiser cannot accept the Va financing if availability into the house is minimal anytime of the season.

Virtual assistant direction suggest that your home have to be secure to view for all those and you will car. In case the dream home is situated on a soil path, this is exactly difficulty. Of course, if your residence comes with a backyard and is also banned, it is considered an access problem.

Lead-situated decorate

We can to be certain your you never should live in a property that have lead-depending paint. Its an extreme health chance.

Towards residential property centered in advance of 1978, people shed, cracked, or cracking decorate to the otherwise exterior should be repaired on account of the possibility of head toxic contamination. But not, if it’s determined that top honors color top is leaner compared to the laws-permitted top, it does stand.

Room enough

What is actually deemed due to the fact enough liveable space is actually upwards to own interpretation. There aren’t any minimal area conditions to have a home. There must be enough space to have living, resting, cooking and you will food, and you will sufficient restrooms.

Opening attics and you can crawl spaces

This isn’t an element of the section regarding evaluation towards appraiser, nonetheless it might be an issue if there is no availableness so you’re able to an attic or spider place. In advance of contacting throughout the appraiser, definitely can easily accessibility these places.

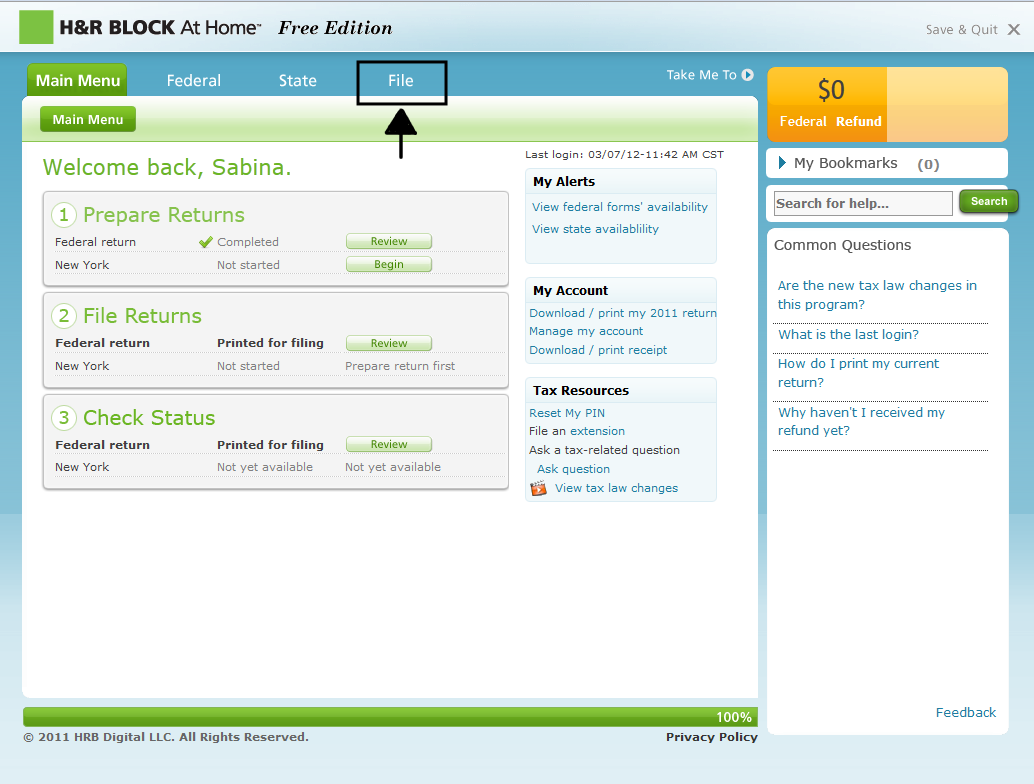

Pursuing the assessment

You can check the newest standing associated with statement because of the calling your own financial. They found a copy of your own declaration regarding appraiser digitally. Appraisers have between five to help you 21 working days East Pleasant View loans to complete the fresh declaration, according to possessions place. Exclusions can be produced to have extenuating affairs.

After that, what you get was a notification useful (NOV). Good Late should include the past appraised value of our home. In the event the discover people factors, they shall be listed in the minimum Possessions Criteria, also the appraiser’s decision out of whether the possessions has gone by or were not successful the fresh new check.

You simply cannot argument an effective Va appraisal, but you can consult an alternative one in the form of an interest or a good Reconsideration of value. In this processes, the functions have transparent access to information. But there is zero guarantee the lead may differ.

In the example of issue, instance marking down the property’s well worth due to a great repairs, you happen to be required to target the vendor to fix this type of points. However, usually regarding thumb, whatever doesn’t meet with the MPRs must be repaired.

Because the customer, you are not obligated to provide the assessment results to new merchant, regardless of if they demand all of them. It could be in your best interest to generally share everything, as possible a bargaining device to reduce the fresh asking price and you can negotiate repairs of the home.

That it appraisal is true to possess six months about big date off the fresh new assessment. In the event it ends, just be sure to consult a unique appraisal. In the event it assessment works, you will be entitled to a Virtual assistant loan and on your treatment for stepping into the home of their aspirations!