Cash-away refinancing may also be used to greatly help consolidate your debt. When you have several highest-interest rate credit cards, making use of the cash out of refinancing to spend people off deliver your a lot fewer individual accounts to be concerned about. You are able to still have to manage to pay brand new loans, however, the good news is it will be together with the financial on an excellent unmarried smoother monthly payment.

Although not, a protected loan also means that you might eliminate your possessions-in this instance, your residence-if not match monthly premiums.

The pros of money-aside refinance

Should you carry out an earnings-away refi? There are many advantages to believe, along with down interest levels (for individuals who ordered your house when costs have been large), dollars having paying off higher-notice loans and handmade cards, and extra returning to settling higher-interest financial obligation.

For those who incorporate the money from your refi with the repaying high-interest funds and you can credit cards, you might spend less as interest into a cash-away refi is leaner than simply that for the credit cards. A finances-aside refi may also give you more hours to blow the new loans back, that’ll lightens certain economic stress.

Using a funds-out re-finance to repay men and women large-attention membership might improve your credit history, but if you are not able to repay toward re-finance, you might be susceptible to losing your home as well as your borrowing from the bank might take a plunge.

Because the home loan focus is tax-deductible, a cash-out refi you are going to provide you with a larger income tax refund into the addition to assisting you decrease your taxable earnings. And since cash-away refinancing enables you to borrow cash on a low cost, using it to obtain bucks for home improvements, educational costs to suit your kids, or any other major bills would be a lot better than taking out fully an additional bank card or loan.

New disadvantages of cash-out refinance

It is vital to envision both the positives and negatives of cash-away finance. It is not the best services for everybody and sells particular threats, including:

Well-known chance is that you could dump your home if not continue to make regular repayments on the the brand new home loan. In addition to, there is also a go that you may actually end up getting a higher interest rate than just you already have, because refinancing changes the newest terms of the financial.

If the interest is going to increase because of the refinancing, you will need to perform some math and you will consider whether or not that additional cash is worthy of they. Without a reduced interest rate than just you currently have, normally, this is better to maintain your current home loan. Also, you should do the mathematics toward people closing costs your may be needed to expend after you re-finance. Closing costs are different, but the majority is hundreds otherwise several thousand dollars. If it’s particularly highest compared to cash you are taking aside, a profit-out refi may possibly not be worth every penny.

While the a cash-out refi takes fifteen so you can 30 years to repay, you may not want to use this for selecting short-name or deluxe items, particularly a different sort of vehicles otherwise a secondary. You need to really just contemplate using it for the boosting your a lot of time-term americash loans Trinidad financial situation, maybe not placing oneself for the better financial obligation and you can risking your property.

How a funds-away refi works

Just as with their fresh mortgage, when you refinance your property, there are obvious measures involved in the procedure. Here is what you really need to predict when qualifying and getting acknowledged having a cash-away refi.

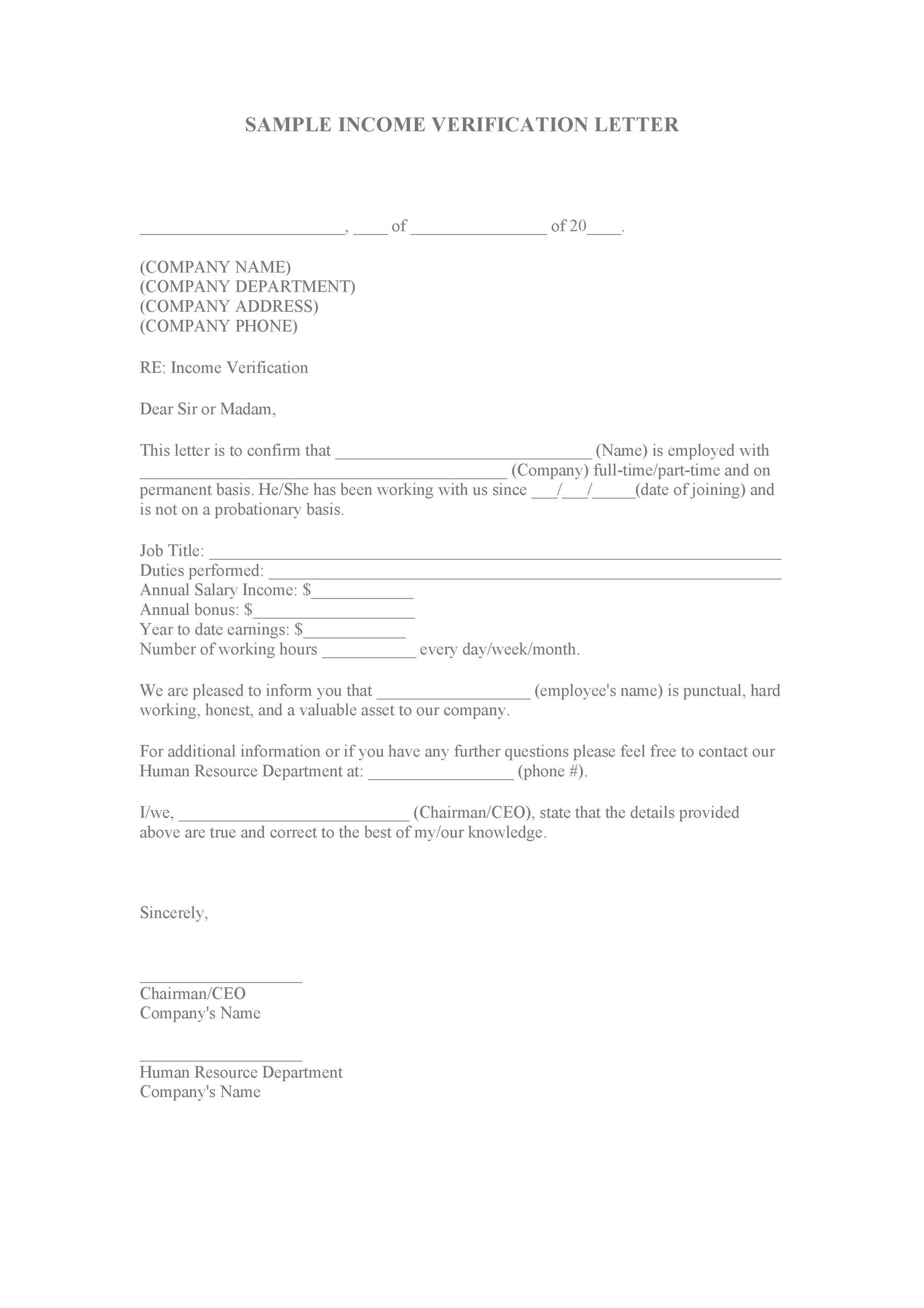

step one. Provide records

After you submit an application for a finances-away re-finance, you ought to deliver the exact same kind of records required for your amazing home loan. This consists of tax returns, W-2s, pay stubs, bank comments, and you may a credit report. These data files make it possible to make sure your collector of borrowing from the bank worthiness.