People against difficult monetary moments often resort to financing supplied by the latest FHA otherwise Federal Construction Government. These types of finance will always be the gold lining for all those experience bitter monetary adversity. These types of funds are provided with many advantages, especially the low down payments (cheaper than just step 3.5%). This type of flexible conditions are offered so you’re able to individuals which includes borrowing challenges minimizing earnings. Apart from following the effortless guidelines needed of the FHA, new homes will be suffice certain criteria to possess brief acceptance. On this page, we shall attention more about our house and that does not satisfy the fresh standards out of a keen FHA financing, evaluate less than:

Knowing the Maxims

Basic something first, we want to understand the concepts of the mortgage supplied by the new FHA. New Federal Housing Administration try ruled of the Service out-of Construction and you may Metropolitan Invention (HUD). Hence, it is unavoidable that governing muscles creates the principles to possess a property when it comes down to rejection or acceptance. You FHA is responsible for ensuring home loans it is circuitously working in capital them. Here, the lenders (banks) gamble a vital role in getting the home denied otherwise accepted.

The new FHA need its using loan providers to adopt the fresh new assessment inspection reports, which have becoming carried out by a keen FHA-accepted appraiser. The lenders, with the underwriting recognition, work at account of your FHA, hence property suffices its put requirements to have insurance. So it insurance cover obtains the lending company when a loan debtor defaults from the a later stage.

Mortgage Limitations

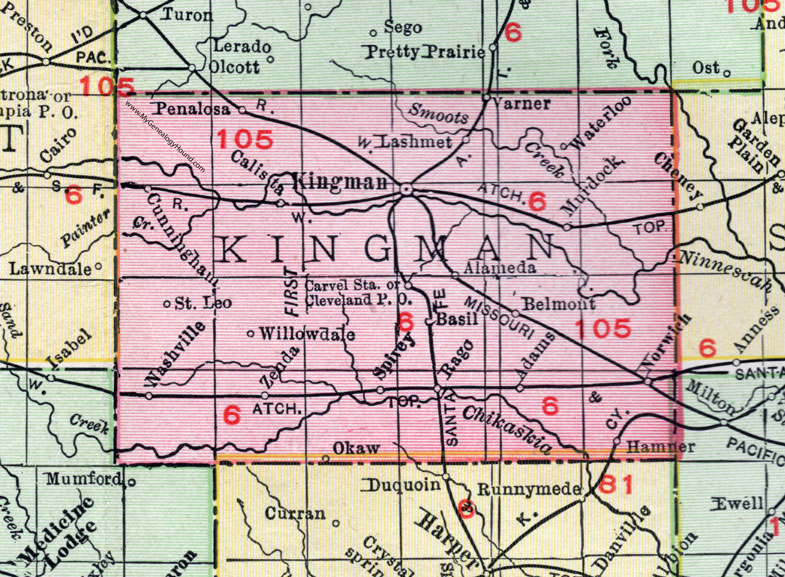

One high priced family doesn’t qualify for a keen FHA loan for obvious factors. The fresh ruling looks (DHU) establishes loan restrictions per year, and therefore disagree by quantity of devices and venue. New FHA has its own restrictions as far as the mortgage amount is concerned. Any pricey home with the usual FHA down payment of step three.5% will give you a loan amount surpassing the lay maximum. For example, Bay area Standing provides the maximum loan limits because it is one of a costly cost town. It has a threshold of about $729,750 for just one house.

There, a property can cost you up to $800,000 which is added to the absolute minimum advance payment amount of $28,000 to have individuals exactly who neglect to be eligible for FHA. The mortgage amount remains higher in the an astonishing price of $772,000. New borrower will need up to $43,000 so you’re able to be eligible for a house towards payday loan Homewood Canyon the loan.

Condition

For FHA foreclosed homes, the fresh FHA can once again generate this type of belongings eligible for the loan. The newest FHA-insured home certainly are the attributes which have solutions only $5000. Yet not, one low-covered belongings of FHA enjoys resolve expenses of more than $5000. You might sell it courtesy HUD given such dont getting eligible for any the brand new FHA money.

The lenders bring their final telephone call in the rejecting or giving the newest financing your candidate. But not, the new comparison of an effective house’s standing by the an enthusiastic appraiser stays an crucial interest one to affects the choice out-of granting otherwise rejecting people financing. Lenders request that one deficiencies end up being repaired just before giving or rejecting the brand new money.

For example, the lending company need a home that is required to get managed into exposure out-of termites or other wood-ruining bugs, mostly in the event the appraiser denotes pest ruin, and that effects the new structural integrity of the property.

The sorts of Characteristics

Your house loan was declined whether it fails to meet this direction into assets variety of. For instance, FHA fund getting apartments is regarded as around condos developed into the HUD-approved metropolises or buildings. Possible select such as for instance FHA-eligible complexes over the HUD’s portal.

Each one of these complexes can merely adhere to the fresh new HUD requirements getting circumstances for example financial stability, liability insurance rates and you can problems. Brand new built belongings follow specific particular norms. Such as, you’ll find so many forever repaired property over its basis and end up in the true estate tax components. All these services belong to so it conditions when the their framework day drops towards otherwise just before 15th Summer 1976.

Completion

FHA finance is actually practical choice for buying an extensive variety of services. It has been a logical selection for people who have lowest credit ratings (below 680 or so). Having provides such as for instance all the way down rates and you will deposit requirements, FHA fund help to make domestic-to get a practical choice. But really, this has certain conditions to get to know. The aforementioned are a few circumstances one refute the new FHA mortgage; if you continue to have questions, please e mail us.