Samantha Stokes, a first time homeowner, stands in the front regarding their particular the fresh new East Garfield Playground household one she shares together with her teenage d. Stokes is the first person to close with the a property while the section of yet another system the fresh Chicago Casing Power try moving away for first-time homebuyers. | Tyler Pasciak LaRiviere/Sun-Minutes

When Samantha Stokes’ daughter strolled within their the fresh Eastern Garfield Park household for the first time, this new teenager took off their unique boots and you can went around the home.

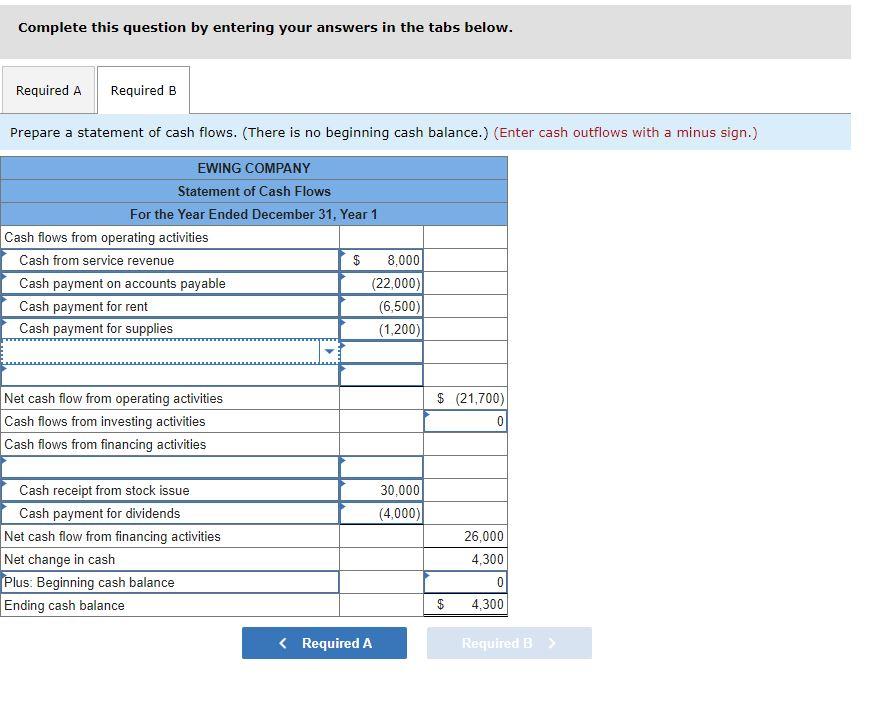

Members should also have at least $3,000 inside deals

So first thing, she visits understand the huge backyard that people provides, in addition to garage and things such as one just like the the woman is never had one in advance of, Stokes recalled. It actually was simply adventure on her behalf face, plus to this day will still be hard to believe I’m an actual homeowner.

About a month in the past, Stokes, 38, closed on her basic home to own herself along with her 14-year-old child. She been exploring to acquire property this past season shortly after she learned their homes possibilities coupon from the Chicago Property Expert carry out probably stage out given that a recently available business campaign increased their unique earnings.

Stokes was in the process of securing a home from the agency’s Will Individual program in the event that department informed her about new Advance payment Advice Program these people were launching who would promote a grant of up to $20,000 to have a deposit and you will settlement costs. Stokes told you they felt like the ultimate storm – inside a great way.

I was therefore intimate to your the brand new closure day from my personal family, it wound up exercise very well for me, she told you.

Samantha Stokes, a primary-date resident, stands about backyard out of their the fresh Eastern Garfield Playground house that she offers along with her adolescent daughter into Thursday. Stokes is the first person to personal towards a home once the section of a unique program the new Chicago Construction Expert is going away getting very first-date homebuyers, the Deposit Guidelines Program.

Stokes ‘s the agency’s very first participant to close on a house within the this new downpayment assistance system. This new $20,000 might possibly be forgivable once a decade.

You will find already more than a dozen most other users behind Stokes who were deemed eligible for the fresh new grant and are usually inside the the entire process of purchasing property, said Jimmy Stewart, new director regarding home ownership to possess CHA.

New department programs it will be able to help in the 100 players on the program’s first year, Stewart told you. The program is financed as a result of government funds from the brand new U.S. Agency out of Homes and you will Urban Invention.

When you’re Stokes got a property coupon through the homes authority, Stewart said the application form was offered to some body – along with men and women lifestyle beyond Chi town – provided our home purchased is in the city’s limits.

Yet not, the application form do become most other qualifications requirements, including becoming a first-date homebuyer who’ll utilize the property since their no. 1 residence, the guy told you. At exactly the same time, recipients’ earnings shouldn’t go beyond 80% of area median income.

It means just one adult’s money are going to be during the otherwise shorter than $61,800, and you may a household regarding about three need to have a household of cash of or below $79,450.

Brand new housing expert would want the application to simply help discount proprietors who’re drawing near to 80% of your urban area average income, definition he or she is receiving reduced assistance but may keep clear away from trying homeownership, Stewart said. CHA residents just who build right above the 80% endurance due to change to their earnings would be to nonetheless apply, particularly because they are almost certainly on the brink out of dropping a good discount otherwise casing recommendations.

The applying appear given that financial prices always boost over the country. 57% the 2009 month, this new Relevant Force advertised.

As a result of the weather that people have with regards to mortgages immediately and other people venturing out in order to homeownership, Stewart told you, we believe that throws all of them from inside the a competitive advantage and you can lets these to manage to buy the domestic and have provides an affordable month-to-month financial matter that’s it’s achievable instead CHA advice following.

Stokes acquired $20,000 from the the brand new property expert program, and an alternative $10,000 from a different sort of advice program. She also used $5,000 regarding her very own discounts buying south west Top, contemporary unmarried-family https://paydayloanalabama.com/clio/ home, which meant in total she got merely over 15% of your total cost of the house.

She before lived in a small one or two-bed room apartment, nevertheless the brand new home also offers more room having herself and her child. Stokes said she’s paying down towards the their own home detailed with a good big home in which she currently envisions children playing around during coming family rating-togethers. An out in-equipment automatic washer and you can drier mode she don’t needs to generate trips to your laundromat.

Her brothers and you may father has actually open to make any required solutions, though the home is yet another build. Their mom, which lives close, has been a normal invitees.

They all must pick out the additional rooms and you can state that’s its area once they come more than, she said.

The rate for a thirty-season home loan flower in order to seven

Samantha Stokes, a first-time resident, stands regarding home away from their particular new Eastern Garfield Park domestic you to she offers with her teenage daughter. Stokes ‘s the earliest individual close toward a home as the part of another type of system the fresh new il Homes Expert was rolling away to own earliest-big date homeowners.