Choose Your Trading Account

However, the range of deposit and withdrawal options as well as commissions charged per trade can be improved upon. Before deciding to trade with this broker, make sure that it meets your trading needs. At FXStreet, we aim to provide our readers an honest and impartial look at certain brokers that you might be interested in trying. Founded in 2009, WorldTradex has established itself as a global broker offering a comprehensive range of trading services in forex and CFDs. The platform is primarily designed to support traders ranging from beginners to intermediate levels.

Zero rejections or requotes on trades.

The program is designed to benefit active traders based on their trading volume. The eligible trading accounts are the micro and standard accounts only. At WorldTradex, traders have the opportunity to explore a wide variety of tradable markets, with popular platforms like MT4, MT5, and the WorldTradex App offering access to numerous Forex and CFD instruments. If currency pairs are your preferred market, you can gain great market exposure and trade over 50 currency https://worldtradex.pro/ crosses.

- You can use either of these two platforms, depending on the asset you are trading.

- For example, if you have not used a credit card or a crypto account for deposits, you do not need to create one for withdrawals.

- No matter the platform you choose for your trades, you can be sure that you will enjoy great market exposure.

- This is an extremely affordable deposit minimum, allowing traders to pick from a list of convenient payment methods to fund their trading accounts.

- Everyone who chooses WorldTradex has the same opportunity to pursue their investment goals.

Ratings and reviews

WorldTradex has a great mobile trading platform, which is offered on MT4 and MT5. The platform is highly user-friendly and provides a great search option. The key point is that you must follow the withdrawal hierarchy for the deposit methods you have used before selecting any other withdrawal option. For example, if you have not used a credit card or a crypto account for deposits, you do not need to create one for withdrawals.

- Each account variation is suitable for traders with different trading goals and preferences.

- The WorldTradex profile consolidates all your trading accounts under the same email, allowing you to login with your email address.

- The layout is straightforward, making it easy for beginners and experienced traders to find their way around.

- Enjoy low fees, exceptional conditions, and super-fast order execution.

- First, there is negative balance protection, which means that even if markets move rapidly against your trades, your account will not be negative.

- In contrast to some other brokers that charge an admin fee after a certain time period.

Clients also get access to trading ideas and analysis to help them better understand financial markets. At WorldTradex, traders can choose from two trading account types – Ultra Low and Zero. Each account variation is suitable for traders with different trading goals and preferences.

Minimum Account Deposit Requirements

You can trade crypto pairs, such as BTC/USD and ETH/USD; or crosses, such as BTC/XRP. This variety allows traders to gain access to many assets, thereby allowing them to maximize their trading strategies. Ultimately, WorldTradex is a reputable broker with many tools for new and experienced traders to maximize their trading strategies. The platform offers low fees and spreads as well as comprehensive educational content for traders.

As a trusted broker, WorldTradex is regulated by tier-one regulatory bodies and takes measures to guarantee the safety of your funds and information. Additionally, there are live trading education sessions, video tutorials, and platform guides for both beginner and advanced traders. Ultra Low accounts offer tighter spreads for cost-conscious traders, though they are not eligible for the Loyalty Program.

BestBrokers.com does not assume liability for the financial losses our readers can potentially incur while trading with the online brokers we shortlist. Readers should bear in mind online trading with leveraged derivatives carries a high level of financial risk. It is, therefore, unsuitable for those who lack proficiency and sufficient experience. The registration process at WorldTradex is straightforward and swift, especially if you are only looking to start exploring the broker with a Demo account. Even if you decide to activate a Real Account, you can complete the mandatory account verification process in less than 10 minutes. In addition to Forex, other markets covered by the broker include Commodities, Stock CFDs, Precious Metals, Thematic Indices, Equity Indices, and Energies.

Assets Review

Once you have provided your personal information, you will be required to choose a trading platform. As with most regulated platforms, WorldTradex broker requires your personal information and details while setting up an account. You will need to provide accurate information as these will be verified later using a government-issued ID. There are several account types available and you can choose whichever suits you during the signup process.

No matter the platform you choose for your trades, you can be sure that you will enjoy great market exposure. You can follow our link and check the Free Live Forex Webinars hosted by WorldTradex for yourself. These can be combined with the technical and market analyses provided daily.

Ratings and reviews

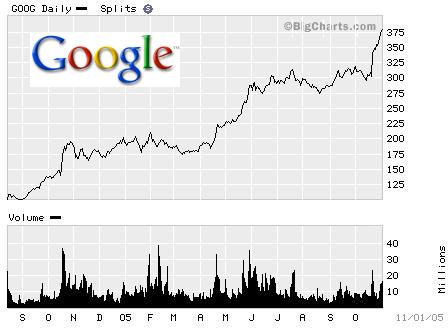

When it comes to actually making trades, however, traders must keep in mind that $5 is nowhere close to a sufficient amount to place an order. Even if you trade with micro lots, a trade of 0.01 lots will indicate placing an order of 1,000 units of your base currency. That is why we recommend making bigger deposits to fund your trading accounts with sufficient amounts. WorldTradex Global offers a similar selection of instruments and provides higher leverage options in some instances. It includes more than 50 cryptocurrency CFDs available only in regions regulated by the Financial Services Commission (FSC) of Belize. While both WorldTradex entities provide a comprehensive range of trading options, specific offerings may vary due to different regulatory requirements.

.jpg)

.jpg)

.jpg)

.jpg)

.jpeg)