The bank was a proper capitalized $step one billion and lender

Rising prices possess slowed substantially for the past 24 months, but there’s a detachment ranging from just what rising cost of living analysis reveals and what millions of Us americans state they are feeling. To possess proof of the fresh stickiness out of inflation, observe this week’s payrolls statement having a record of average hourly earnings. There is certainly a top correlation ranging from moderate earnings and you will core-attributes CPI ex lover-coverage, which is the Fed’s prominent way of measuring center rising cost of living. If root work criteria again heat up, financial policymakers may find on their own against a special wage-rising cost of living spiral.

Backed by most readily useful traders, you will find began $12B into the financing frequency and they are broadening punctual!

Prepay increase has reached a couple-12 months highs (with regards to the Freeze Home loan Display), and we was viewing delinquencies creep upwards, that’s not so great news to have MSR profiles. The delinquency rate enjoys gone doing 3.5 per cent, since the solitary month death, the degree of this new profile one to prepays four weeks, increased to 0.64 %, the highest just like the .

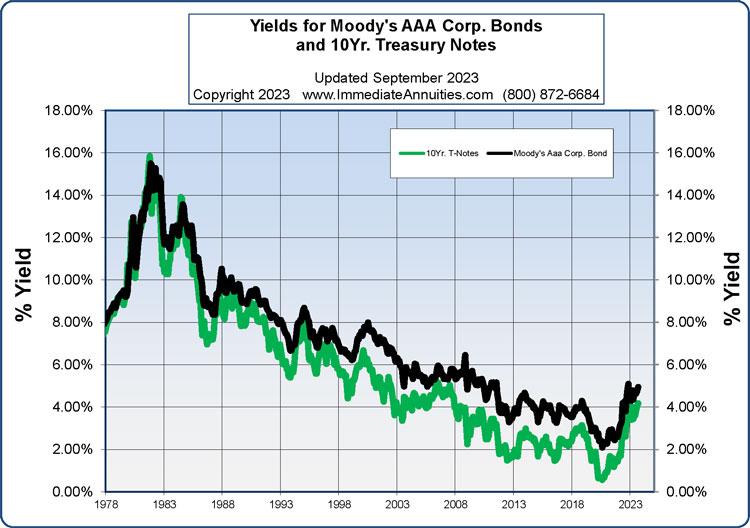

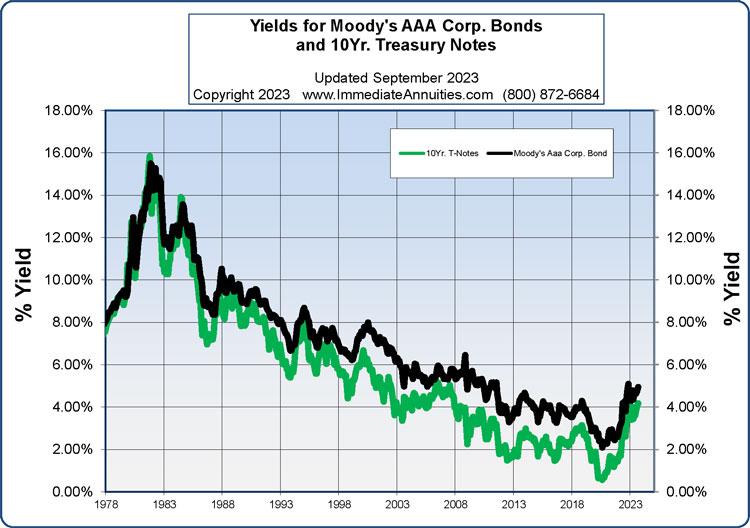

Cutting-edge symptoms for September banged off the current monetary calendar. The great investments shortage with merchandising and you will general inventories. Later today brings Redbook exact same shop conversion process, September home rates of Instance-Shiller and you may FHFA, October consumer count on, JOLTS business openings, Dallas Fed Tx qualities, and you can Treasury auctions and that is headlined by the $forty two million 7-year notes and you will $30 mil 2-season FRNs. I start the day off with Company MBS rates even worse in the .125 out-of Monday’s intimate, the brand new ten-seasons yielding 4.thirty two immediately after closure past on cuatro.twenty-eight per cent, therefore the dos-12 months on cuatro.sixteen. (más…)