A fixed-rates financial is interested rate one remains the exact same getting the complete label of one’s mortgage

The latest Government Casing Government (FHA) was a national agency designed to make sure mortgages that assist anyone who don’t qualify for other kinds of mortgage loans to get an excellent family. Within the FHA loan program, the new company pledges money made by private loan providers, providing to blow the funds in case your debtor defaults. Those who sign up for FHA money have to pay an initial mortgage top and a home loan advanced getting the life of your own loan.

Fixed-Rates Home loan

That have a fixed-rates financial, you could potentially protect a reduced rates whenever interest rates are reduced. If you purchase whenever cost is large, you could refinance after in the event that prices get rid of.

Foreclosure

If the a debtor ends up making repayments on mortgage, the lending company normally foreclose with the mortgage, meaning the financial institution requires control over the house or property. For the foreclosure procedure, the lending company will try attain back the balance owed towards the the borrowed funds, have a tendency to of the offering the house.

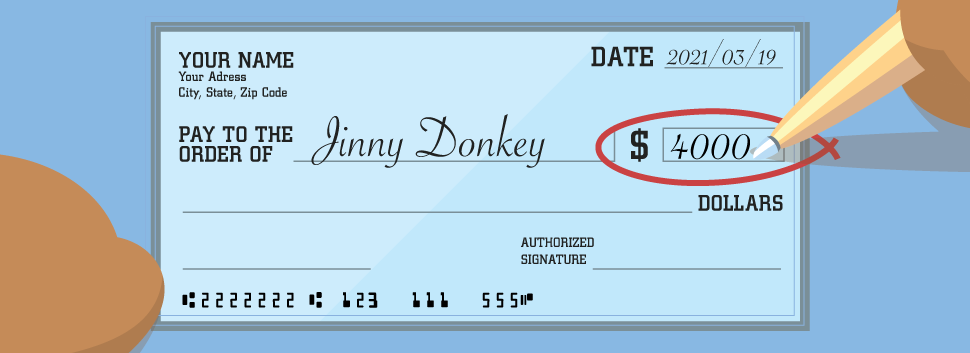

Good faith Imagine

A good faith imagine are a questionnaire a loan provider provides whenever one applies having home financing or reverse mortgage. It gives an in depth listing of the expense that could be linked to the loan.

Household Inspection

Property review was a visual examination of the house one is normally a portion of the homebuying techniques. The brand new check helps make the buyer conscious of prospective products for the a property. A purchaser can use all the details gleaned on check in order to discuss toward vendor. (más…)