Most for the most part, there’s a handful of items that might happen for many who standard toward that loan

- Past, compensatio morae is even described as mutual default. This describes a posture where the borrower and creditor have been in standard for the reciprocal debt. As an example, within the a sale deal, in case your supplier does not deliver the goods and also the visitors fails to afford the speed, both at the same time, this could be compensatio morae.

These concepts are important during the choosing responsibility and you can treatments in the contractual disputes. In the civic legislation circumstances, such three decide which people was at fault, as to get redirected here what training, and you may exactly what effects would be to go after.

General Ramifications regarding Defaulting

The ensuing list would depend not only on sorts of mortgage you are defaulting on your credit rating, web worth, liquid assets, and you will legal position along with your loan deal. We will evaluate way more particular results of defaulting towards the specific products out-of financial obligation later.

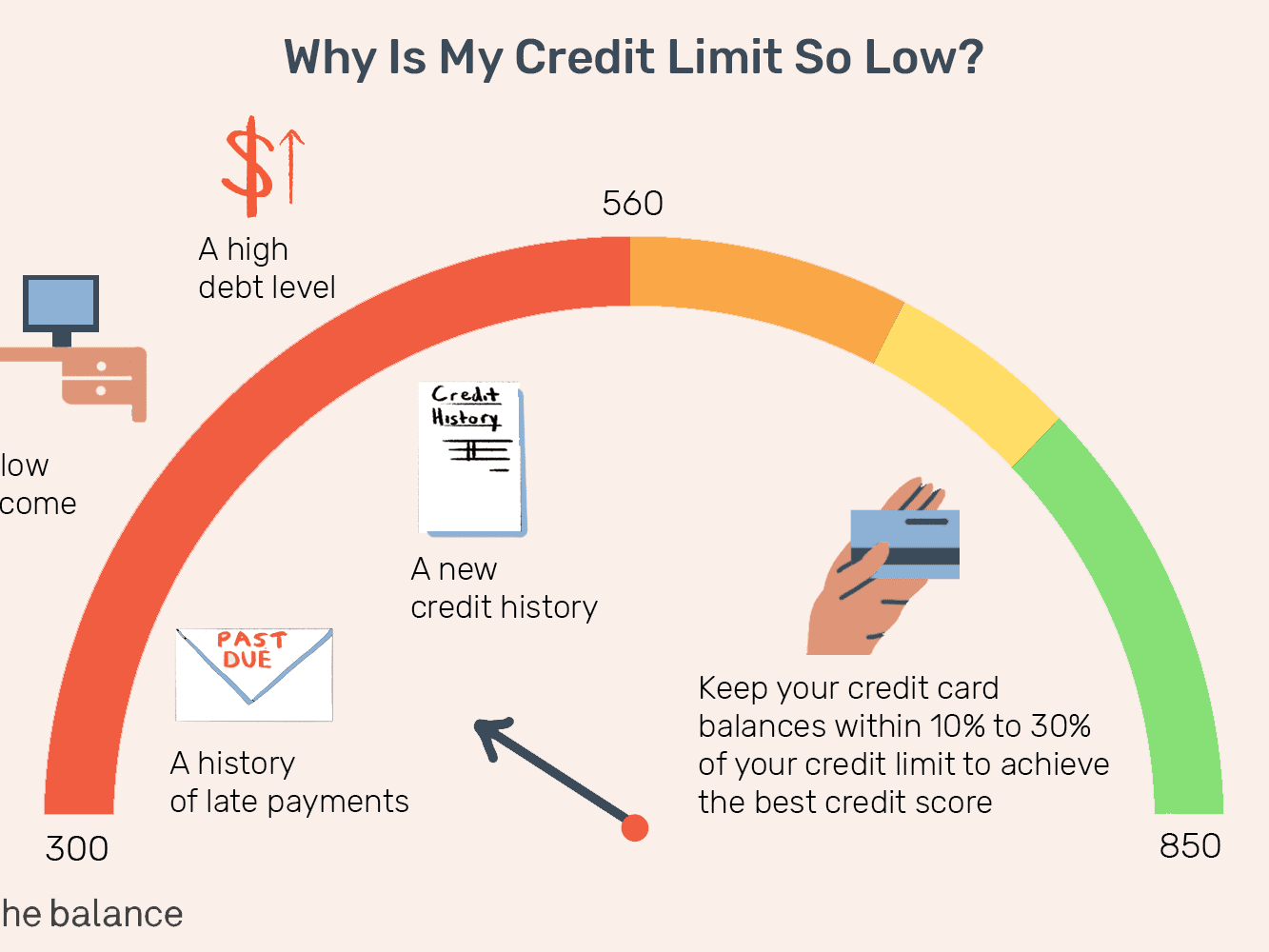

- Credit history Ruin: Defaulting into the obligations you may really perception your credit score. Late repayments and non-payments is reported so you can credit agencies and certainly will remain on your credit report for approximately 7 many years. (más…)