First Tennessee Lender Letter.A great. Believes to invest $212.5 Million to resolve False Says Work Accountability As a result of FHA-Insured Mortgage Lending

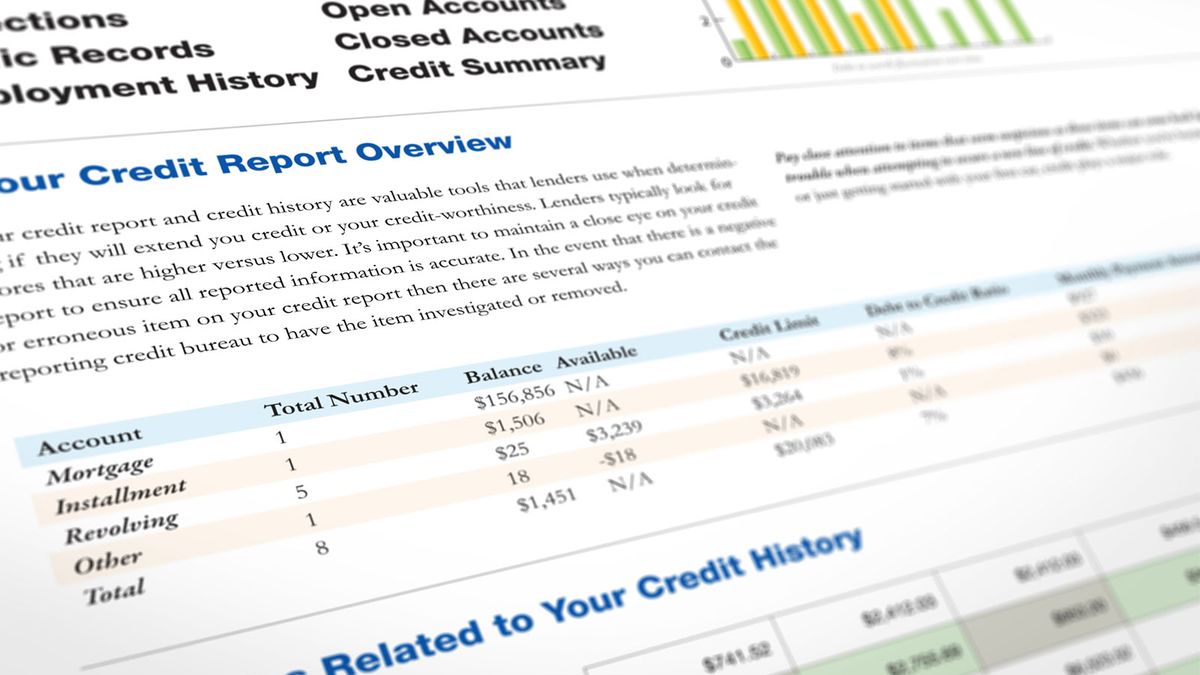

First Tennessee’s conduct caused FHA to help you guarantee numerous funds you loans Troy AL to definitely weren’t qualified to receive insurance policies and you will, this is why, FHA suffered large losses if it later reduced insurance rates says into the those people money

Very first Tennessee Financial N.A beneficial. has wanted to afford the United states $212.5 million to answer accusations that it broken the new Untrue States Operate from the knowingly originating and underwriting mortgage loans covered by U.S. Institution away from Housing and you will Urban Development’s (HUD) Federal Construction Government (FHA) you to did not meet relevant conditions, the Justice Department established now. First Tennessee are based inside the Memphis, Tennessee.

Very first Tennessee’s irresponsible underwriting features triggered significant losings of federal loans and you may is precisely the kind of run one to caused the overall economy and you can housing market downturn, said Dominant Deputy Secretary Attorneys General Benjamin C. Mizer of your own Fairness Department’s Civil Section. (más…)